Understanding Oil Market Trends in Canada

The Canadian oil market is a complex and dynamic entity, offering unique opportunities for passive income through strategic trading. This analysis delves into current trends and their potential impact on traders seeking long-term gains.

Current Market Dynamics

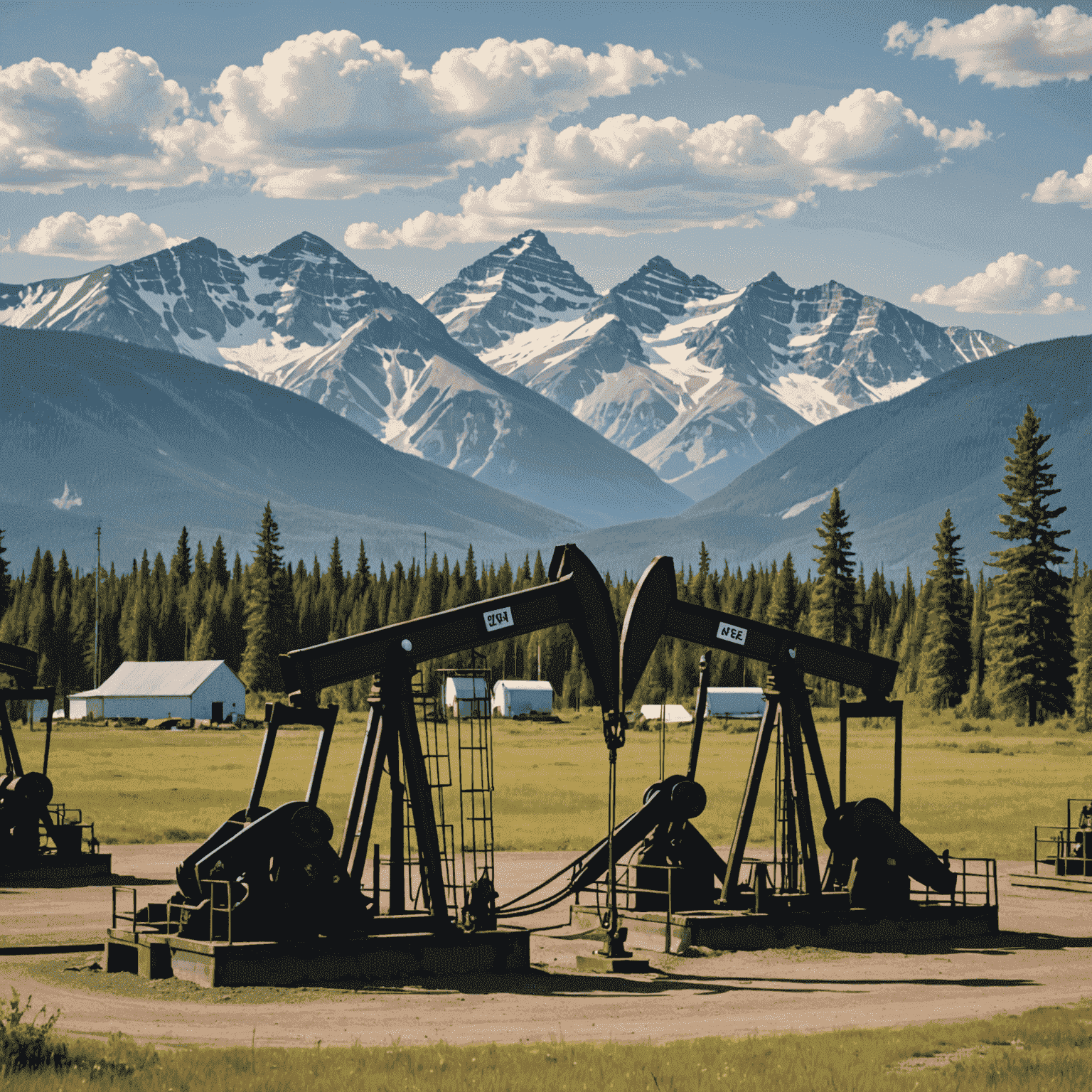

Canada, as the world's fourth-largest oil producer, plays a significant role in global energy markets. Recent trends show:

- Increased focus on oil sands production

- Growing emphasis on environmental regulations

- Fluctuating global demand affecting export opportunities

Impact on Passive Income Strategies

For traders looking to capitalize on these trends for passive income, consider the following:

- Long-term investments in major Canadian oil companies: These often offer stable dividends, providing a steady passive income stream.

- ETFs focused on Canadian energy sector: These provide diversified exposure to the market with minimal active management.

- Royalty trusts: Some Canadian oil and gas companies offer royalty trusts, which can yield high returns based on resource production.

Key Factors to Watch

To maximize passive income potential in Canadian oil trading, keep an eye on:

- Pipeline developments and transportation infrastructure changes

- Global climate policies and their impact on Canadian oil demand

- Technological advancements in extraction and refining processes

- Geopolitical events affecting global oil markets

Conclusion

The Canadian oil market presents unique opportunities for generating passive income through informed trading strategies. By understanding current trends and their implications, investors can position themselves for long-term gains in this dynamic sector.

Remember, while the potential for passive income is significant, oil trading carries inherent risks. Always conduct thorough research and consider consulting with financial advisors before making investment decisions.