Getting Started with Oil Trading

Oil trading can be an excellent avenue for generating passive income, but it requires a solid understanding of the market fundamentals. This guide will introduce you to the basics of oil trading and help you get started on your journey to potential long-term gains.

Understanding the Oil Market

The global oil market is complex and influenced by various factors. Before diving in, it's crucial to grasp these key concepts:

- Supply and demand dynamics

- Geopolitical influences

- OPEC's role in oil production

- Different types of crude oil

Types of Oil Trading

There are several ways to engage in oil trading:

- Futures Contracts: Agreements to buy or sell oil at a predetermined price on a specific future date.

- Options: Contracts that give you the right, but not the obligation, to buy or sell oil at a specific price.

- CFDs (Contract for Difference): Financial derivatives that allow you to speculate on oil price movements without owning the underlying asset.

- Oil Company Stocks: Investing in shares of oil-producing companies.

Getting Started: Steps for Beginners

- Educate Yourself: Learn about oil market fundamentals, technical analysis, and risk management.

- Choose a Broker: Select a reputable broker that offers oil trading and suits your needs.

- Practice with a Demo Account: Most brokers offer demo accounts where you can practice trading without risking real money.

- Start Small: When you're ready to trade with real money, start with small positions to minimize risk.

- Stay Informed: Keep up with oil market news, geopolitical events, and economic indicators that affect oil prices.

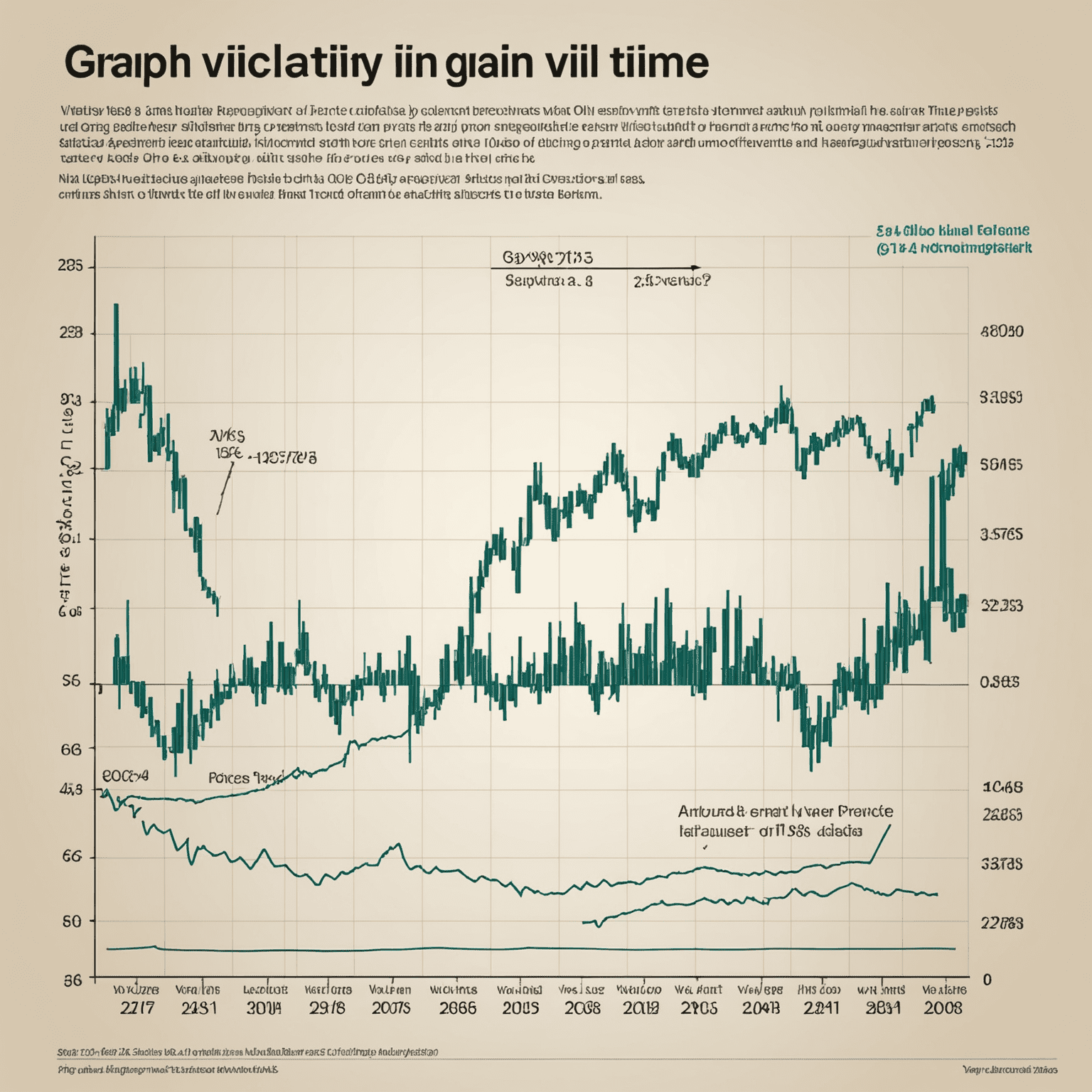

Risk Management in Oil Trading

Oil trading can be volatile, so it's essential to implement proper risk management strategies:

- Set stop-loss orders to limit potential losses

- Diversify your portfolio to spread risk

- Never invest more than you can afford to lose

- Use leverage cautiously, as it can amplify both gains and losses

Conclusion

Oil trading can be a lucrative way to generate passive income, but it requires patience, education, and careful risk management. By understanding the basics outlined in this guide and continuously learning about the market, you'll be better equipped to navigate the world of oil trading and work towards long-term gains.

Remember, while oil trading offers potential for passive income, it's important to approach it with caution and consider seeking advice from financial professionals before making significant investments.